Over 60 years of trust. Ready for what’s next

Serving Filipinos since 1963, we carry our legacy forward with a new name and a renewed vision for modern banking

BSP-licensed and regulated

Fully compliant and operating with a Basic Electronic Payment and Financial Services (EPFS) license

Insured by PDIC

Deposits are insured by the PDIC up to ₱1 Million per depositor

A part of Salmon Group Ltd. Company

Backed by IFC (a member of the World Bank Group) and ADQ/Lunate, Abu Dhabi’s sovereign wealth fund

2024 at a glance

Growth in 2024

Driven forward with Salmon Group Ltd.’s support

In total assets

Our diversified portfolio includes deposits and consumer loans

Time deposit rate

Our digital-first model lets us offer one of the best rates in the market

Our story

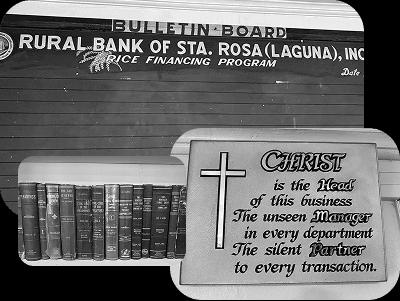

1963

Maria Paz Salgado Melencio established the Rural Bank of Sta. Rosa (Laguna).

2022

BSP launched a Rural Bank Strengthening Program to encourage mergers and consolidations of rural banks.

2024

Salmon Group acquired the bank to support the program. Launched time deposit and saving products.

2025

Rural Bank of Sta. Rosa (Laguna), Inc. is being approved by BSP to operate under Salmon Bank name. Salmon Bank gains Basic EPFS license.

Raffy Montemayor

“The Rural Bank of Sta. Rosa (Laguna) has been a trusted part of Filipino lives since 1963. With Salmon guiding its next chapter, the Bank is building on a strong foundation. Because no matter how advanced banking becomes, it always starts with trust, integrity, and genuine local relationships.”

Reliable returns for your money goals

Expert support from your own Relationship Manager

Flexible terms from 6 months up to 5 years

Insured up to ₱1 Million by the Philippine Deposit Insurance Corporation (PDIC)

Build your savings with confidence

Grow your savings by up to 8% p.a. with Salmon Time Deposit

Reach your savings goals faster with one of the best available rates in the Philippines

Open an account

Compliance and transparency

BSP license

The Anti-Money Laundering Council (AMLC)

Financial reports

Salmon Bank leadership

Salmon Bank (Rural Bank) is formerly known as Rural Bank of Sta. Rosa (Laguna), Inc.

Media features

Oct 26, 2025

The Salmon Bank makeover: Co-founder Raffy Montemayor reimagines 60-year-old bank for the digital age

Read full story

Aug 13, 2025

Salmon’s rural bank eyes sustained loan growth in H2 2025

Read full story

Jul 4, 2025

Former Monetary Board member joins board of Rural Bank of Sta. Rosa

Read full story

Build your savings with confidence

Grow your savings by up to 8% p.a. with Salmon Time Deposit

Reach your savings goals faster with one of the best available rates in the Philippines

Open an account

Our branches

Offices are located in Sta. Rosa, Laguna, and Bacoor, Cavite

Branch: Bacoor, Cavite

141 General Evangelista Street Barangay Poblacion, Bacoor City, 4102 Cavite

Under renovation: Sta. Rosa, Laguna

F. Gomez St., Poblacion, Barangay Malusak, City of Sta. Rosa, Laguna 4026

FAQs

Yes, the Rural Bank of Sta. Rosa (Laguna), Inc. is now Salmon Bank (Rural Bank) Inc. as a reflection of our new mission and direction as part of Salmon Group Ltd. This change is official and approved by the Bangko Sentral ng Pilipinas. You may view our Certificate of Authority here.

Yes, we are officially licensed by the Bangko Sentral ng Pilipinas (BSP). You may find our listing on the BSP website under the previous name of the bank – Rural Bank of Sta. Rosa (Laguna) Inc. Information regarding the new name will be updated on the BSP website later accordingly.

The requirements to open a bank account include one (1) valid government ID, and one (1) recent 1X1 ID photo. An Alien Certificate of Registration is required for foreign nationals.

Here are the IDs you can submit for your application:

- Unified Multi-Purpose Identification (UMID) Card

- Driver’s License

- PhilSys ID (Philippine Identification System ID)

- Social Security System (SSS) Card

- Philippine passport

- Postal ID

PRC and Voter’s IDs are not accepted. Also, we only accept the plastic card PhilSys ID, not the digital or printed version.

- Maintenance – Free of charge

- Checkbook Fee – Free of charge for accounts with deposits of ₱500,000.00 and above; a ₱500 charge for accounts with deposits of ₱499,999.99 and below

- Fee for Issuance of Bank Statements – Free

- Certification of Deposit Fee – Free

- Tax – 20% withholding tax applied to matured time deposit accounts

- Dormancy Fee – ₱30, applied after 5 years of inactivity

- Stop Payment Order Charge – ₱2,200

Yes, deposits are insured by the Philippine Deposit Insurance Corporation (PDIC) for up to ₱1 Million per depositor. For more information, you may visit https://www.pdic.gov.ph/

Yes, a joint account shall be insured by PDIC separately from any individually-owned deposit account/s. If the account is held jointly by two or more natural persons, the maximum insured deposit shall be divided into as many equal shares as there are individuals unless a different sharing is stipulated in the document of deposit. For more information, you may visit https://www.pdic.gov.ph/di_howtofileclaims_dot

For Regular Savings Deposit, the client will earn 3% interest rate per annum. Demand Deposit is a non-interest-bearing deposit.

For Time Deposit accounts the interest rate will depend on the amount of deposit placement and with the chosen term. Please see the following interest rates below.

Deposit amount — ₱50,000.00 to ₱499,999.99

- 6 months — 6%

- 9 months — 6%

- 12 to 60 months — 6%

Deposit amount — ₱500,000.00 to ₱999,999.99

- 6 months — 6%

- 9 months — 6%

- 12 to 60 months — 6.5%

Deposit amount — ₱1,000,000.00 to ₱50,000,000.00

- 6 months — 6%

- 9 months — 6%

- 12 to 60 months — 8%

Clients can open an account at Salmon Bank (Rural Bank) Inc. Head Office, located at F. Gomez St., Barangay Malusak, Sta. Rosa, Laguna. They can also visit our Bacoor Branch, located at Evangelista St., Barangay Daang Bukid, in Bacoor City, Cavite.

You can also get started online. First, fill out our application form here. Then, one of our telesales representatives will get in touch to walk you through Salmon Time Deposit. Afterwards, they will assign a Relationship Manager to assist you in completing the account opening process – at your preferred schedule, and in the convenience of your own home or office.

Your account starts earning interest as soon as money is credited to the account. Interest is earned monthly and will be credited to your Time Deposit account at the end of each month. All interest earnings are subject to a 20% withholding tax, as required by law. If you leave interest on the Time Deposit, then compound interest will be applied and this rate will be obtained:

Deposit amount — from ₱50,000.00 to ₱499,999.99

6 months — 6.06%

9 months — 6.10%

12 months — 6.13%

24 months — 6.28%

36 months — 6.44%

48 months — 6.60%

60 months — 6.77%

Deposit amount — from ₱500,000.00 to ₱999,999.99:

6 months — 6.06%

9 months — 6.10%

12 months — 6.66%

24 months — 6.83%

36 months — 7.02%

48 months — 7.21%

60 months — 7.41%

Deposit amount — from ₱1,000,000.00 to ₱50,000,000.00

6 months — 6.06%

9 months — 6.10%

12 months — 8.24%

24 months — 8.51%

36 months — 8.79%

48 months — 9.09%

60 months — 9.40%

You can also choose to have your earned interest paid out every month to your checking account instead of adding it to your Time Deposit.

Once your deposit is opened, you can cash in using two methods:

1. With the Salmon app

- Via PESONet:

Go to your Checking account in the Salmon app, tap “Cash in,” and choose PESONet. Copy your Checking account details from the app and paste them into the e-wallet or bank app you’re using to transfer funds.

2. Without the Salmon app

- Over the counter:

Visit any of our bank branches. - Via PESONet:

Ask your relationship manager for your Salmon Checking account number. In your e-wallet or bank app, choose Salmon Bank (Rural Bank) Inc. as the receiving bank and enter your Checking account details. Share the transfer confirmation with your manager. They’re always ready to assist with any questions.

Minimum initial deposit: ₱50,000

To get the maximum return of 8%, your deposit must be at least ₱1,000,000. This lets you continue earning from the highest interest rates available under the current terms.

Withdrawing your money after the maturity period will not affect any interest earned from the previous term. Your account will automatically roll over or extend to a new term, unless you specify otherwise. This means that if you don't take action, your funds will continue to earn interest according to the terms of the new period.

It’s best to keep your deposit until maturity to get the full interest rate. If you withdraw your funds before the maturity date, your Time Deposit will be pre-terminated.

In this case:

- You will earn a reduced interest rate of 1.00%.

- A pre-termination fee of 0.75% of your initial deposit will also be applied.

Joint account ownership

Joint account is an account held jointly by two or more natural persons, or by two or more juridical persons or entities. Joint accounts shall be insured separately from any single or singly-owned deposit account.

The aggregate of the interests of each co-owner over several joint accounts, whether owned by the same or different combinations of individuals, juridical persons or entities, shall likewise be subject to the Maximum Deposit Insurance Coverage of Php1,000,000.

For more information, you may visit https://www.pdic.gov.ph/di_howtofileclaims_dot.

Corporate Accounts

- By-laws with the SEC Certificate of Filing

- Board Resolution authorizing the opening of the account

- Board Resolution designating the authorized signatories for the account

- Corporate Secretary’s Certification of Elected Officers

- Two (2) pieces each of recent 1x1 pictures of authorized signatories

- Two (2) acceptable IDs of the authorized signatories opening the account

- General Information Sheet

- License to do business in the Philippines or Certificate of Exemption, if foreign entity

If you have any other questions about your Salmon account or need help with something not covered in our Help center, the best way to reach us is through Customer Service via in-app chat in the Salmon app.

This is our primary and most secure point of communication, and our team can provide a tailored resolution based on your concern.

If you simply want to reach out for general inquiries or clarifications, you can also contact us through our official social media channels:

Facebook: @salmonphilippines

Facebook Community: Salmon PH Community

Instagram: @salmon_philippines

TikTok: @salmonphilippines

Our Customer Service team is always ready to assist you and make sure you receive the support you need.